Inside the Adversary

Hey team,

Plenty of things to discuss in the headlines this week, but the real events are happening in places most people aren’t looking. Peace talks are moving quietly, cyber hits are landing, and military manoeuvres are setting the pace.

Here’s what matters now and what to watch in the coming days.

Disclaimer

All insights in this report are drawn from adversarial OSINT channels to provide an unfiltered view of non-Western aligned actors and narratives. Content reflects source claims and framing; inclusion does not imply verification.

Bottom Line Up Front

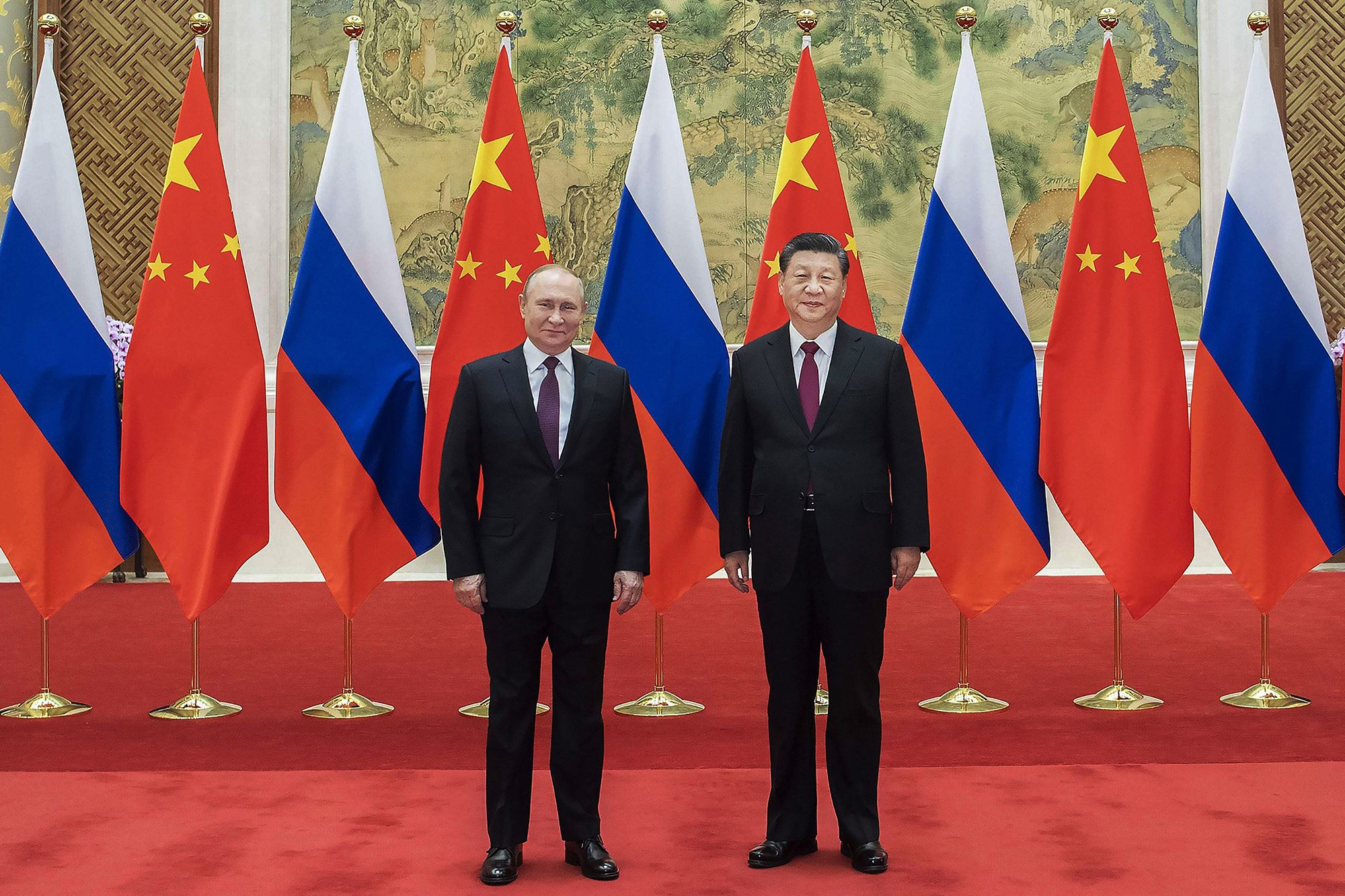

Russia and China tightened political and energy alignment around the SCO summit, including plans tied to Power of Siberia 2 and visa-free access for Russians to China. Israel signalling expanded operations in Gaza coincided with claims of Houthi drone strikes and visible ISR activity over Lebanon, while the United States reported a lethal maritime strike on a Venezuelan-linked drug vessel. Information operations pushed competing narratives on Europe’s support calculus, Israeli domestic politics, and alleged GPS jamming, while economic messages highlighted Russia-China energy integration, nuclear cooperation ambitions, and South Africa’s land policy posture.

Diplomacy

Russia and China presented deeper strategic alignment around the SCO meetings. Channel posts flagged leaders’ engagements in Beijing and highlighted a planned energy build-out between the two countries including Power of Siberia 2. Messaging also noted a move to year-long visa-free entry for Russians to China starting 15 September.

In the Middle East, Israel was reported to be reassessing a gas arrangement with Egypt and a US delegation visit to Beirut was flagged. Iranian messaging balanced openness to “rational negotiations” with the United States with parliamentary discussion of responses up to potential NPT withdrawal amid snapback pressure. Venezuela accused Guyana of provocation over a border incident, and Russia designated the UK’s RUSI as “undesirable,” adding diplomatic friction with London.

Short-term outlook: It is likely Moscow and Beijing will publicise additional deliverables from SCO-linked tracks, including energy and travel facilitation. It is possible Israel-Egypt gas discussions stay paused pending security dynamics, and there is a remote chance of rapid movement on Iran-US talks given Tehran’s mixed signalling.

Information (Cyber & Influence)

Narratives targeted European and transatlantic cohesion. Posts cited a Wirtualna Polska piece framing Europe as looking to Washington and Trump on Ukraine and amplified claims linking EU trade concessions to US support. Another line claimed alleged GPS jamming of von der Leyen’s flight that Flightradar24 posts were said to contradict.

Domestic Israeli sentiment and legitimacy were targeted through polling and leadership-rift content. Channels pushed a Channel 13 poll figure favouring the IDF Chief of Staff over the Prime Minister, plus emotive framing around Gaza and Syria. A video link alleging a Ukrainian drone swarm attack inside Russia circulated to drive audience and shape perceptions of escalation.

Short-term outlook: Coordinated messaging around the SCO, Russia-China energy, and Israeli decision-making is likely to persist. It is possible further “debunk”-style posts will counter Western claims, while viral videos of strikes will almost certainly be used to sustain attention and shape sentiment.

Enrolments for the Intelligence Analyst Certification Course (IACC) are now open. The IACC is accredited, scenario-driven, and built to take your tradecraft from theory to real-world application. Join aspiring analysts from around the world already sharpening their intelligence edge:

Military

Indicators of expanded Israeli operations were prominent. Posts showed IDF equipment build-up and new reservist mobilisation alongside claims of Houthi multi-target drone strikes on Israeli infrastructure. Channels also noted a new Ofek-19 reconnaissance satellite, an MQ-9 presence over southern Lebanon, and a surface-to-surface launch observed from northern Palestinian areas.

Ukraine-related updates stressed Russian advances and attrition claims, with political signalling in Germany ruling out troop deployments absent a ceasefire. Additional posts described increased Ukrainian strikes on Crimea’s air defence and maritime targets. Separately, the United States reported a lethal strike on a suspected drug vessel that departed Venezuela.

Short-term outlook: It is likely Israel will intensify operations in and around Gaza and maintain ISR over Lebanon. Crimea will likely face continued Ukrainian unmanned and missile activity, while US maritime interdiction in the Caribbean is possible but with an unlikely chance of immediate regional escalation.

Economic

Energy cooperation dominated. Posts touted a Russia-China pipeline build-out reaching a reported 106 bcm once fully operational and highlighted Rosatom’s stated intent to help China overtake US nuclear capacity. Visa-free access for Russians to China was signalled as an enabling measure aligned to the broader economic relationship.

Other economic narratives included claims that EU trade concessions for US energy and defence imports were tied to Ukraine support, and Poland’s request to join the G20 by 2030. South African messaging praised Zimbabwe’s early-2000s land confiscation process, signalling continued debate on land expropriation policies.

Short-term outlook: Russia-China energy integration is almost certain to remain a headline theme, with announcements likely tied to pipeline and nuclear cooperation messaging. It is possible EU-US trade linkage narratives continue, while South African land policy debate will likely persist without near-term resolution.

Closing

Plenty of movement across the board this week - Russia and China tightening links, Israel ramping up, cyber narratives flying, and economic plays reshaping energy and trade. The pace isn’t slowing any time soon.

What are you keeping an eye on? Drop your take in the comments and let’s see where the next month takes us.

Responses