Special Report: Venezuela

Plenty of things to discuss in the headlines this week, but this special edition locks onto one theatre: Venezuela. A US raid has removed Nicolás Maduro, airstrikes have hit Caracas and other northern targets, and a lot of people are already asking what comes next.

BLUF

In the early hours of 3 January, the United States launched Operation Absolute Resolve, a large air and special forces raid across northern Venezuela that captured President Nicolás Maduro and his wife, Cilia Flores, and flew them to New York to face narcoterrorism charges, with at least 80 people killed including 32 Cuban personnel. The US frames this as a lawful action against a criminal leader, while many states at the UN describe it as an illegal act of aggression and a severe breach of Venezuelan sovereignty.

Inside Venezuela, interim president Delcy Rodríguez has declared a state of emergency, unleashed security forces and colectivos, and begun rounding up suspected collaborators and journalists, even as the wider regime structure remains in place. Markets are reacting more calmly than many expected, with oil prices volatile, US energy stocks up, and analysts seeing only gradual change in Venezuela’s output while sanctions and infrastructure problems persist.

Over the next month, the key questions are whether the post-Maduro leadership fractures, how far Washington pushes its threatened “second wave”, and whether repression or armed resistance inside Venezuela starts to spiral.

Diplomacy

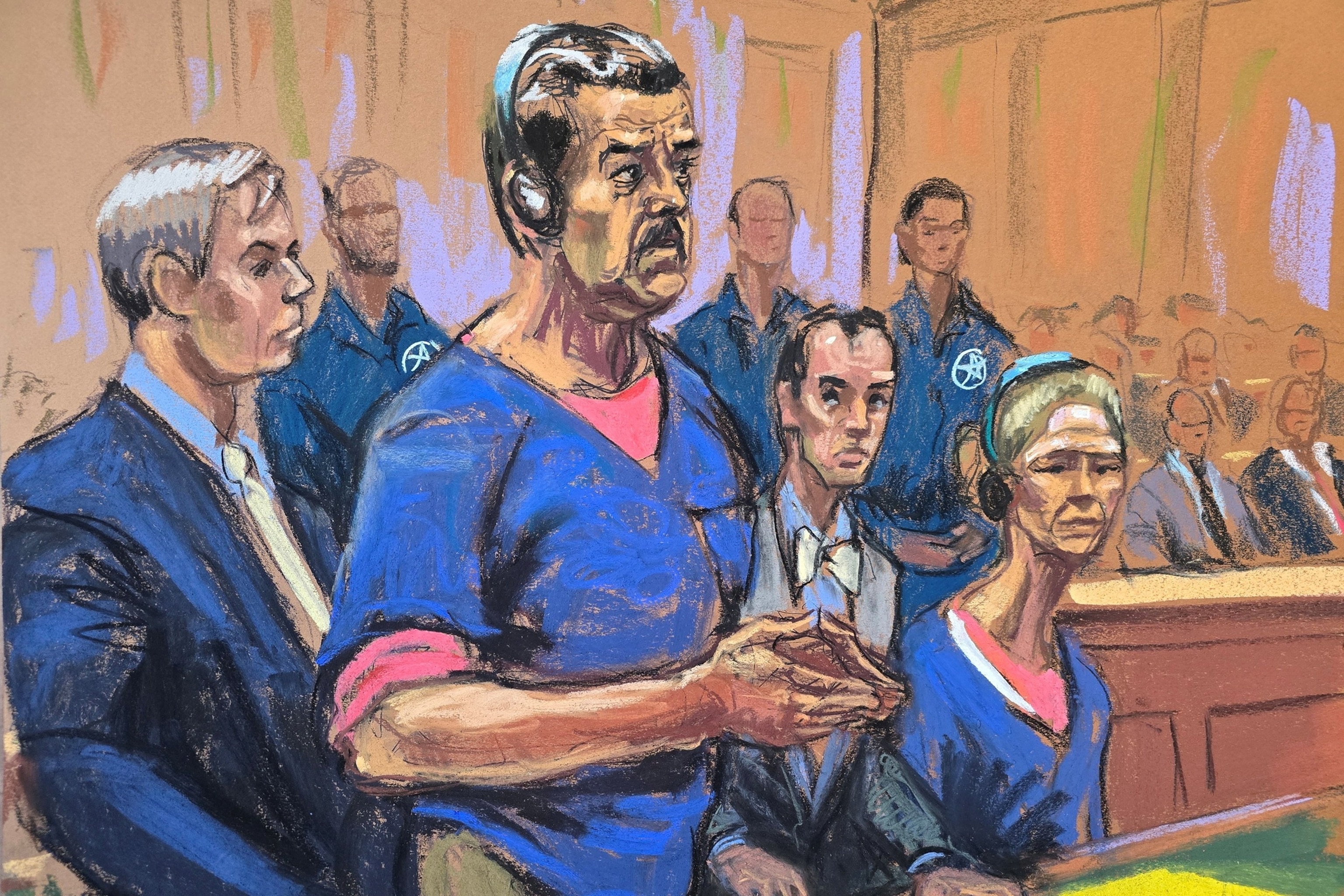

On 3 January, US forces conducted a concentrated operation across northern Venezuela, involving more than 150 aircraft, to support an apprehension team that seized Maduro and Flores in Caracas and removed them to US custody. Maduro has since appeared in a Manhattan court, pleaded not guilty to narcotics and terrorism charges, and described himself as a kidnapped president, while Washington insists he is a criminal suspect, not a legitimate head of state.

At the UN Security Council, the strikes triggered an emergency session where a wide range of states, including several US partners, condemned the operation as a crime of aggression and a dangerous precedent that sidelines multilateral decision-making. The US defended its actions as a collective security step based on long-running narcotics indictments and an asserted right of self-defence, but it can block any Council resolution that directly censures the strike. The European Commission has signalled guarded support for a Venezuelan-led democratic opening while avoiding a clear stance on the legality of the raid itself.

Regionally, reactions are split. Cuba has denounced the attack after confirming the deaths of 32 of its officers in Venezuela, and several Latin American governments have criticised the intervention, while some others and parts of the Venezuelan diaspora abroad have welcomed Maduro’s removal but remain uncertain about the path ahead.

Short-term outlook (Diplomacy)

Over the next month, it is almost certain that diplomatic debate will stay focused on legality and precedent rather than a coherent roadmap for transition. A formal UN condemnation looks unlikely given the US veto, but a General Assembly resolution or regional statements from bodies such as the OAS are likely. It is possible that a Contact Group or set of “friends of Venezuela” starts to form around proposals for elections or mediation, although any structured process led by external actors remains uncertain in the near term.

Information (Cyber & Influence)

Narratives around the raid are hardening quickly. US officials, including Trump and senior advisers, are presenting Maduro as a captured narco-terrorist whose removal demonstrates renewed deterrence and a tougher approach to cartels and hostile regimes. Maduro, Rodríguez and allied media call it a kidnapping and an imperialist assault, insisting he remains Venezuela’s only legitimate president and that the country is under external occupation.

Inside Venezuela, the information environment is tightening. Reports indicate that security forces and colectivos are patrolling opposition neighbourhoods, stopping residents, checking phones for pro-US content, and detaining journalists, with at least 14 reporters already arrested and some still unaccounted for. State outlets emphasise Cuban casualties and civilian deaths from the strikes, framing the operation as proof of US aggression in the region.

At the same time, connectivity is being partially re-routed around regime controls. Starlink has announced free satellite internet service for Venezuelan users for a limited period to offset power and network outages after the strikes, repeating its role in earlier conflicts and raising questions about the influence of private tech in wartime communications. Opposition activists and diaspora groups are already using external platforms to push footage of damage, celebrations, protests and crackdowns.

Short-term outlook (Information)

An intense struggle over the story of the raid is almost certain in the next month, with both Washington and Caracas pushing selective imagery and casualty narratives. It is likely that the Venezuelan government will keep tightening media space at home, including more arrests and blocking of platforms, while activists rely increasingly on satellite links and foreign outlets. There is a realistic possibility of cyber operations or hack-and-leak activity by pro-government, sympathetic or opportunistic actors, although significant, clearly attributed cyber attacks on US or allied infrastructure remain uncertain at this stage.

Click here to enrol in the free training

Military

Operation Absolute Resolve appears to have lasted a little over two hours, using air and missile strikes to suppress Venezuelan air defences and key military sites while US special operations forces moved into Caracas to seize Maduro and Flores. Venezuelan officials report more than 80 dead including soldiers, police, and civilians, and Cuba says 32 of its officers embedded with Maduro’s security were killed. Trump has said only two US soldiers were injured.

Despite the scale of the strike, core elements of the Venezuelan state and armed forces remain in place. The Supreme Tribunal ordered Vice President Delcy Rodríguez to assume the presidency, armed colectivos have been deployed across Caracas, and the defence minister has condemned the operation while signalling that the military is still organised and intends to resist further incursions. Along the Colombian border, security forces have been mobilised amid concern about spillover or refugee flows.

Trump and some advisers speak publicly about the US “running” Venezuela for a period and warn that a “second wave” of action could follow if the interim leadership does not cooperate, yet Washington has not announced an occupation or long-term ground presence. Many analysts note that Maduro’s personal removal is a tactical success but that the wider regime network, including security services and colectivos, still holds territory, weapons and patronage.

Short-term outlook (Military)

Over the next month, large-scale US ground deployment into Venezuela looks unlikely, although a continued presence offshore and in nearby airspace is almost certain. Limited follow-on strikes, shows of force or special operations are possible if Washington judges that Rodríguez or security elites are obstructing its aims. Internally, it is likely that colectivos and security forces will intensify repression, and there is a realistic possibility of armed clashes between regime elements, opposition groups and criminal networks as power rebalances. Border incidents with neighbouring states remain a concern but, in the near term, most violence is likely to stay inside Venezuela.

Economic

Venezuela holds the largest proven oil reserves in the world but has been producing under 1 million barrels per day after years of sanctions and mismanagement. Following the strikes, financial markets reacted with a mix of higher energy stocks, volatile oil prices and increased demand for safe-haven assets. Brent and WTI saw short-term gains before easing, while the Dow and S&P energy index hit record or near-record levels on expectations that US firms might eventually win access to Venezuelan fields.

On the ground, the picture is more constrained. The US embargo on Venezuelan crude remains, PDVSA has reportedly asked some joint ventures to cut output because export channels are blocked, and December already saw a steep fall in shipments as shadow fleets and traders pulled back ahead of the strike. Analyst estimates suggest that, even with a political shift, it would take at least two years to raise production significantly due to decayed infrastructure and financing needs, with any large output increase likely to pull global prices down only later this decade.

For China and other key buyers of Venezuelan oil, the raid adds uncertainty over supply reliability and repayment of debts tied to oil shipments. Internally, continued sanctions, damage from strikes and political turmoil risk worsening shortages, inflation and migration flows in the short term, regardless of longer-term investment promises.

Short-term outlook (Economic)

In the month ahead, global markets are likely to keep treating Venezuela as a source of geopolitical risk rather than meaningful new supply, so oil prices may show bursts of volatility but are unlikely to shift dramatically on Venezuelan fundamentals alone. It is likely that PDVSA output will remain flat or dip further while sanctions and logistical disruptions persist. Inside Venezuela, economic conditions for households are likely to deteriorate, with a realistic possibility of spikes in inflation, fuel and power shortages and renewed migration pressure on neighbouring states if repression and uncertainty continue.

This special edition gives a first cut of what happened in Venezuela and the immediate paths that look open. What have you been monitoring in this evolving situation? Let us know!

Responses